Thinking Like a Buyer, Not Just a Builder

In the hustle of growing a business, it’s easy to get caught up in the day-to-day — chasing new clients, expanding services, and keeping operations running smoothly. But growth alone doesn’t guarantee a valuable company. True financial wellness means building transferable value — the kind that endures even when you’re not in the room.

Whether your goal is to sell in 2 years or scale for 20, learning to think like a buyer rather than just a builder will transform the way you run your business.

At Breaking the Mould Accounting Limited, we help £1M–£20M turnover businesses apply valuation lenses to everyday decisions — ensuring that every pound of effort contributes not just to revenue, but to long-term value creation.

Let’s explore what this means — and how to implement it.

What Is Transferable Value?

Transferable value is the value of your business without you in it. It’s what a third-party buyer, investor, or successor sees as enduring, scalable, and strategically attractive. It's built on strong fundamentals, not just hustle and goodwill.

You might have high revenues, loyal clients, and a great team. But if your processes, knowledge, or cash flows are dependent on your personal involvement, your business isn’t yet transferable — and its value is limited.

Value-Building Questions to Ask Yourself (Like a Buyer Would):

To begin integrating this buyer's lens, consider these critical questions:

-

Is your revenue recurring, or does it reset every month?

- Builder's thought: "We're hitting our monthly targets!"

- Buyer's thought: "How predictable is this revenue? How much effort is required each month to re-earn it? Does the business have a stable base of contractual or subscription-based income that provides forecasting certainty?"

- Why it matters: Recurring revenue models (subscriptions, retainer agreements, long-term contracts) are highly valued by buyers. They indicate stability, predictability, and a lower customer acquisition cost over time. Businesses with high churn or project-based, one-off revenue streams are inherently riskier and thus less valuable.

-

Are key processes and knowledge dependent on you or scalable systems?

- Builder's thought: "I'm the go-to person for everything; that shows my importance!"

- Buyer's thought: "How much risk is concentrated in the owner or a few key individuals? Can this business operate effectively without them? Are there documented processes, clear organizational structures, and scalable systems in place?"

- Why it matters: A business heavily reliant on the owner's personal involvement for daily operations, sales, or even critical decision-making is a significant liability for a buyer. They are acquiring an asset, not a job. Documented processes, automated systems, and a strong, empowered team reduce key-person risk and demonstrate transferability.

-

Is your margin improving in line with revenue growth?

- Builder's thought: "Revenue is up, so we're growing!"

- Buyer's thought: "Is this growth profitable growth? Are economies of scale being realized, or are costs escalating at the same rate (or faster) than revenue? What's the true profitability trend?"

- Why it matters: Revenue growth is exciting, but it means little if profitability is stagnant or declining. Buyers look for businesses that can scale efficiently. Improving margins alongside revenue growth indicate operational efficiencies, pricing power, and a healthy business model.

How Buyers Think — And Why You Should Too

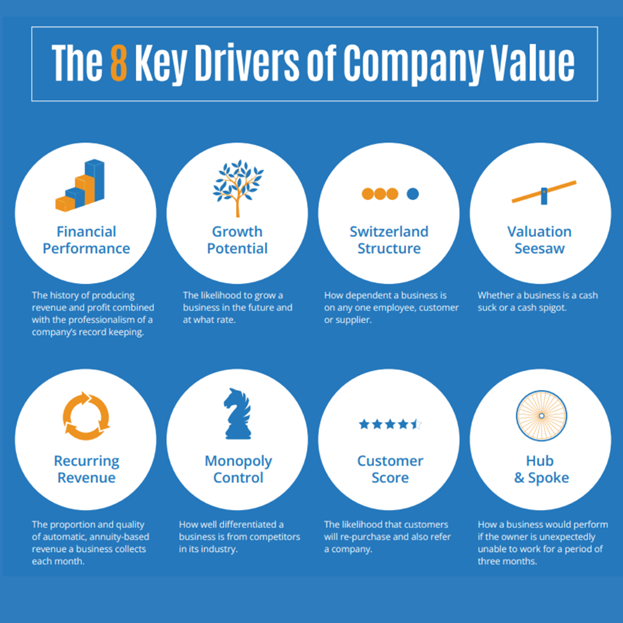

Buyers don’t just look at profits — they assess risk, scalability, and future return on investment. Here are just a few lenses they use when evaluating businesses:

| Buyer Lens | What They’re Asking |

|---|---|

| Revenue Quality | Is income reliable, repeatable, and growing? |

| Customer Concentration | Are revenues spread or reliant on a few clients? |

| Operational Dependence | Can the team function without the owner? |

| Growth Potential | Can this business double in size without doubling costs? |

| Legal and Financial Hygiene | Are contracts, books, and compliance clean and current? |

Our Approach: Embedding Valuation Thinking Into Everyday Decisions

At Breaking the Mould Accounting Limited, we work with ambitious founders to integrate value-building frameworks into their operational playbook. That means:

-

Advisory-driven financial reporting, not just compliance.

-

Quarterly board-style reviews of KPIs linked to valuation drivers.

-

Exit-readiness assessments, even if you're not exiting.

Every pricing tweak, hiring decision, or system implementation either adds to — or detracts from — the long-term value of your business. We make sure those decisions are aligned with your future, not just your now.

If you're unsure where your value gaps are — or how your business might be perceived by a buyer — let’s talk.

📞 Book a free Value Discovery Call with one of our strategic advisors.

We'll assess your business against buyer benchmarks and show you the quickest ways to increase its worth — even if you’re not looking to sell.

🔜 Next Week on Financial Wellness Wednesday:

Risk Management: Finding and Fixing Hidden Financial Fragilities

From customer concentration to cyber exposure, next week we’ll explore the silent threats that could destabilise your financial health — and how to de-risk your business for resilience and growth.

.jpg)